Accruals

Accrued Expense Journal Entry

Accounting for prepaid rent doesn’t have to be complicated, but it does require attention at month-end-close. In a basic general ledger system, an accountant or bookkeeper records a prepaid asset to a balance sheet account. This may require an adjusting entry to reclass rent expense Accrual Accounting & Prepayments to a prepaid account. Going forward, a monthly entry will be booked to reduce the prepaid expense account and record rent expense. While some accounting systems can automate the amortization of the prepaid, a review of the account should occur every accounting period.

Accrual Example

From a tax standpoint, it is sometimes advantageous for a new business to use the cash method of accounting. https://online-accounting.net/accrual-accounting-038-prepayments/ That way, recording income can be put off until the next tax year, while expenses are counted right away.

Expense Vs. Cash Timing

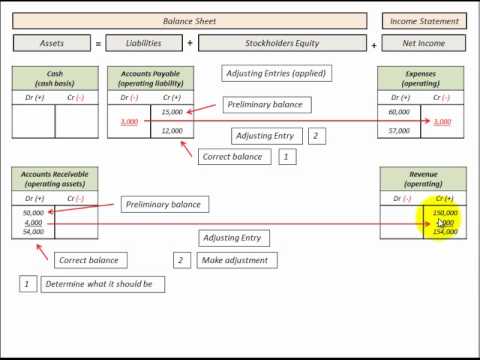

AccountDebitCreditCash AccountXAccrued Liability AccountXWhen the original entry is reversed (showing you paid the expense), it’s removed from the balance Accrual Accounting & Prepayments sheet. To record accrued expenses, use debit and credit journal entries. In accrual accounting, you must use a double-entry bookkeeping system.

What is an accrual journal entry?

An accrual is a journal entry that is used to recognize revenues and expenses that have been earned or consumed, respectively, and for which the related cash amounts have not yet been received or paid out. It is most efficient to initially record most accruals as reversing entries.

Rent As A Prepaid Expense?

Accruals and prepayments are adjustments that we make to ensure that expenses and income are recognised in the correct accounting https://online-accounting.net/ period. Prepaid rent is recorded as an asset when an organization makes a prepayment of rent to a landlord or a third-party.

Since accrual accounting is a challenging task for companies to record because every time a transaction happens, there has to be an entry made in the books of accounts. As such, the maintenance of accounting of accrued expense journal entry is a difficult job.

Prepaid Expense

If a business were to not use the prepaids concept, their assets would be somewhat understated in the short term, as would their profits. The prepaids concept is not used under the cash basis of accounting, which is commonly used by smaller organizations.

- Because the company actually incurred 12 months’ worth of salary expenses, an adjusting journal entry is recorded at the end of the accounting period for the last month’s expense.

- Prepaid expenses aren’t included in the income statement per Generally Accepted Accounting Principles (GAAP).

- The adjusting entry will be dated December 31 and will have a debit to the salary expenses account on the income statement and a credit to the salaries payable account on the balance sheet.

- Accrual accounting requires that revenue and expenses be reported in the same period as incurred no matter when cash or money exchanges hands.

- Unlike conventional expenses, the business will receive something of value from the prepaid expense over the course of several accounting periods.

The utility company doesn’t invoice you until after the period. To close your books, you must make an accrued expense journal entry. Accrued expenses can reveal how debts affect the business bottom line before receiving bills. They are temporary entries used to adjust your books between accounting periods.

This method requires you to make two opposite but equal entries for each transaction. With the accrual method, you record expenses as they are incurred, not when you exchange cash. The cash-basis method of accounting does not recognize accrued liabilities. The general idea is that economic events are recognized by matching revenues Accrual Accounting & Prepayments to expenses (the matching principle) at the time in which the transaction occurs rather than when payment is made or received. This method allows the current cash inflows or outflows to be combined with future expected cash inflows or outflows to give a more accurate picture of a company’s current financial position.

With the accrual method, income and expenses are recorded as they occur, regardless of whether or not cash has actually changed hands. The sale is entered into the books when the invoice is generated rather than when the cash is collected. Likewise, an expense occurs when materials are ordered or when a workday has been logged in by an employee, not when the check is actually written. The downside of this method is that you pay income taxes on revenue before you’ve actually received it.

Accruals are expenses incurred but not yet paid while prepayments are payments for expenses for that are not yet incurred. Accruals and prepayments Accrual Accounting & Prepayments give rise to current liabilities and current assets respectively in accordance with the matching principle and accrual accounting.

Accrual accounting requires companies to record sales at the time in which they occur. Unlike the cash basis method, the timing of actual payments is not important. If a company sells an item to a customer through a credit account, where payment is delayed for a short term (less than a year) or long term (more than a year), the accrual method records the revenue at the point of sale.

Is an accrual an asset?

Accrued revenue (or accrued assets) is an asset, such as unpaid proceeds from a delivery of goods or services, when such income is earned and a related revenue item is recognized, while cash is to be received in a later period, when the amount is deducted from accrued revenues.

Prepaid expenses are payments made in advance for goods and services that are expected to be provided or used in the future. While accrued expenses represent liabilities, prepaid expenses are recognized as assets on the balance sheet.

Now Is The Time To Beef Up Your Business Skills With This $35 Training

This can be important for showing investors the sales revenue the company is generating, the sales trends of the company, and the pro forma estimates for sales expectations. In contrast, if cash accounting was used, a transaction would not be recorded for a while after the item leaves inventory. Investors would then be left in the dark as to the actual sales performance and total inventory on hand. Expenditures are recorded as prepaid expenses in order to more closely match their recognition as expenses with the periods in which they are actually consumed.