Digital Download & Installation Instructions

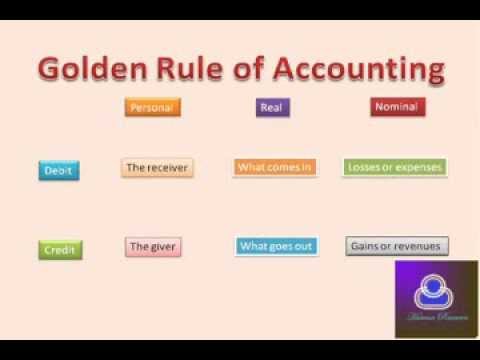

SmartBooks Genie brings a whole new level of efficiency to your Client Accounting Services (CAS). With our seamless integration with QuickBooks, accountants will be able to enhance the client experience with minimal additional work on their part. Our accrual accounting module means you can say goodbye to time-consuming and error-prone manual spreadsheets. Although QuickBooks is a powerful software suite that offers numerous data protection tools, the weakest link of any security chain isn’t usually the software—it’s the users.

Provide NetOps Management on Secret, SI, and colorless networks, devices and services. The NOSC elements contain the TN NetOps Management Subsystems that provide enhanced tactical network planning, administration, monitoring, and response (PAMR) capabilities.

The developed NetOps software enhancements will be provided as a technical insertion to TN NetMod and Mission Network for fielding and support. Subscriptions will be charged to your credit card through your account.

When it comes to data security, the more personnel with access, the higher your risk is. When using QuickBooks Online, be sure to customize user permissions to restrict access to a must-have basis — and don’t share login information among employees. When each employee using the software has their capabilities limited to mission-critical functions, there will be less risk of user error or mishandled data. Users of QuickBooks Desktop must ensure that all of the latest software updates are applied to their software.

Each employee is $4/month for Core, $8/month for Premium, and $10/month for Elite with no additional fees for with direct deposit. 1Phone and messaging support is included with your paid subscription smartbooks login to QuickBooks Online Payroll. U.S. based support is available Monday through Friday 6AM – 6PM PST . 1Same-Day Deposit available to QuickBooks Online Payroll Premium and Elite users.

Set Up Payroll Once, And You’re Done

The system can also provide Low Probability of Intercept (LPI) and Low Probability of Detection (LPD) communications for the user. The SCAMP is designed for the general purpose user, with bookkeeping a weight of 44 lbs and a 15 minute set up/tear down time. It can provide four simultaneous ports, full or half duplex, access to other LDR nets at data rates of 75 bps up to 2.4 Kbps.

And while these features can be disabled in QuickBooks Desktop, they’re always active in QuickBooks Online, providing an uninterruptible way to track and record activity https://www.bookstime.com/ on your system. 1The TSheets mobile app works with iPhone, iPad, and Android phones and tablets. Not all features are available on the mobile apps and mobile browser.

Conquer Payroll. Empower Your People.

High Capacity Line of Sight (HCLOS) is used to maintain a redundant communications link between multiple battlefield locations. The equipment’s primary mission is to provide data services like Secure Internet Protocol Routing and Non-Secure Internet Protocol Routing, as well as video teleconferencing services (BVTC) to remote locations with the help of a Joint Network Node (JNN). The HCLOS is a very versatile and online bookkeeping stable piece of equipment that helps the Brigade with communications and the accomplishment of the overall mission. The Staples Connect concept has been rolled out in six stores in the Boston area. Customers in the Needham and Somerville locations can now get free video consultations with experienced accountants, CPAs, and others on their business challenges, as well as access to other professional services.

- Wideband BLOS connectivity assures more robust synchronized maneuver, fires, space, maneuver support data, rapid information, and data exchange to support intelligence, sustainment, and stability operations in all operational conditions.

- This capability will enable the transport of encrypted unclassified and classified information through the LandWarNet Army’s contribution to the DoDIN to facilitate Mission Command, SA, and Reporting.

- The system will support the Joint Operating Concepts for Major Combat Operations, Deterrence Operations, and Military Support to Stabilization, Security, Transition, and Reconstruction (SSTR) Operations.

The system will support the Joint Operating Concepts for Major Combat Operations, Deterrence Operations, and Military Support to Stabilization, Security, Transition, and Reconstruction (SSTR) Operations. SmartBooks manages the finance departments for https://www.bookstime.com/articles/smartbooks hundreds of small businesses. Whether you need outsourced bookkeeping, accounting, CFO services, tax, payroll or HR help, SmartBooks has a solution to support your small business. We work with clients across the US and across a range of industries.

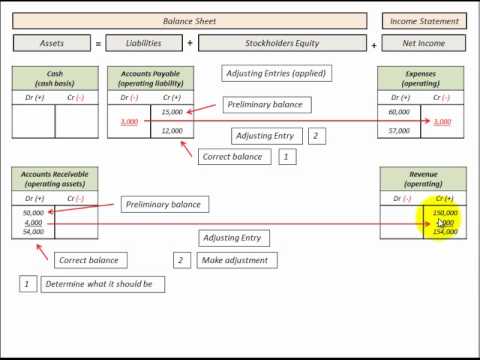

QuickBooks offers several accountability tools to support data protection. QuickBooks features an always-on Activity Log that records all user logins and activities that occur on the platform. For extra monitoring of individual transactions, there’s also an Audit Trail feature that records specific changes made to each transaction.

Browse Titles By Practice Area:

The STT system provides a deployable JNN interconnection capability for satellite support to the US Army. The STT is a part of TN, which consists of the STT trailers, Unit Hub SATCOM Trucks (UHST), JNNs, Brigade Transit Cases, and Battalion Transit Cases to interconnect the systems. In addition, the STT provides seamless connectivity to strategic (fixed) facilities via the Defense Information System Network (DISN) for distribution of DISN services retained earnings throughout the tactical network. With Staples Connect, office supply company Staples is aiming to reinvent its traditional stores with community event spaces, coworking facilities, podcast studios, new layouts and a range of professional services for small businesses, including tax and accounting. Outsourced accounting and business services firm SmartBooks is partnering with Staples Connect to serve the stores’ small-business customers.

Payroll processed before 7AM PST shall arrive the same business day (excluding weekends and holidays). JENM is the tactical edge network manager software application that plans, configures, provisions, monitors, and manages the networking waveforms and SDRs. JENM is capable of importing planning reference data (such as the PD TNI Tactical Radio Report) and provides GUI screens to enter other Unit planning data (such as preset designs) to create SRW and WNW network plans.

When using either QuickBooks Desktop or QuickBooks Online, employees need to be educated on the proper way to create secure passwords, handle sensitive data, and best practices for logging in outside of the office. When this education is combined with QuickBooks’ built-in security features, data security will be a breeze. QuickBooks Online allows multiple users access to the software at once, but be careful about who is given access.

Each MCN-B supports both the Secret and SI security domains, via Secret and SI User Access Cases. The connection between MCN-B User Access Cases and the serving TCN is via tactical fiber optic cable to the TCN.